The Oud Journey

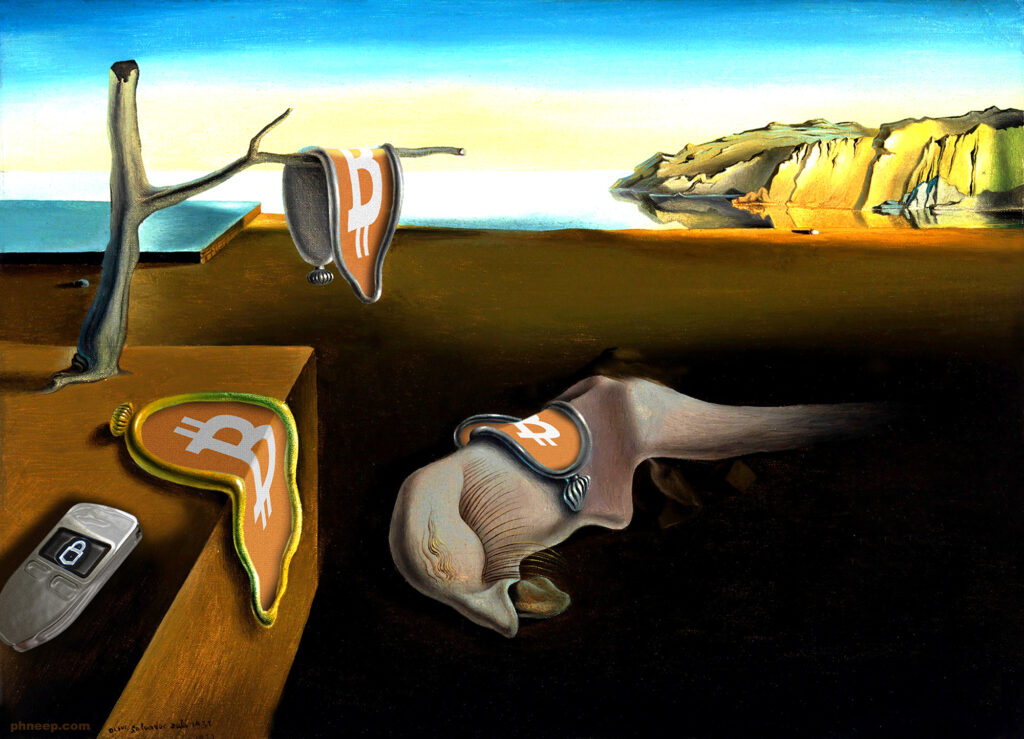

Oud or Bitcoin?

“It Just Works”

Back in the day, I was looking for a dedicated MP3 player. Sound quality and durability were the main things I was after. It didn’t matter which brand, as long as it was not Apple. No way I was buying an iPod.

I used to look for recommendations on sites like “anything but Apple” and, in the end, I bought and had to replace four players in less than six months. A sense of futility led me to succumb to the conformist trend I tried so hard to avoid, and so I did end up with an iPod, after all. It’s still going strong 13 years later. Same thing when I eventually ended up with a MacBook that lasted me almost a decade, while three other laptops kicked the bucket much faster.

You always hear about Apple’s ‘exorbitant’ prices and how you can easily find much cheaper alternatives with better specs to boot. But love ’em or hate ’em, Apple keeps building solid, high-performing machines used and recommended by professionals. The spec sheets of this pixel vs. so much RAM tell you one thing, but four MP3 players later and you realize it’s about more than bits and bytes.

The oud scene is loaded with the same kinda talk about how ‘expensive’ Ensar Oud is, and lots of talk about ‘cheaper’ alternatives – with better specs to boot. Here’s a recent example from Basenotes:

“If someone wants to spend 4,500 USD on a 3 gr bottle of Nha Trang LTD or 7,500 USD for 3 gr bottle of Brunei Kinam then they can go to Ensar Oud. I am sure those oils must be nice, but the price tag is very high as well. On the other side, you can get decent Oud oil for way less money.”

Notice how Ensar Oud is equated with Brunei Kinam and Nha Trang LTD, the most expensive distillations ever undertaken by anyone in the history of aromatics. And oils such as Oud Yusuf and Oud Zachariyya are then compared to the prices of these oils.

It has been clarified over and over that Ensar offers oils at many different price points and entry levels, but for some reason, people keep insisting that ALL of Ensar Oud is “in the region of thousands.”

True, you can get decent oud oil for way less money. Aroha Kyaku ($165) is one example (and of which there’s no comparable profile at any price). Nhek 1976, a 100% wild Kong Kong distillation for $390. Xiang Liao Ling, an 11-year-old Maroke at 13 times less than Brunei Kinam.

Of course, people like our friend above dare not mention these, because then their propaganda would hit the fan rather instantly.

The War on Oud

The ‘War on Oud’ (diplomatically called the ‘democratization’ of Oud) is a campaign that strives to undermine high-grade oil on the premise that all oud (as long as it’s pure) is more or less equally good. It has stirred up a ton of animosity towards true artisanal distillers – Ensar Oud in particular – in favor of a more ‘democratic’ market where ouds like Sultan Ahmet get flagged for being “expensive” because you can find ‘decent oud for way less.’ Power to the people, in other words. Death to the artists.

It’s a dogma that preaches how an increase in the quality of raw materials shouldn’t mean a dramatic increase in the price of oud. Their creed demands that oud distilled from $10 / kg agarwood be comparable in smell and price to ouds distilled from $1,000 / kg wood. Dare to distill the latter, but don’t dare to charge accordingly. That’s the general motto.

It gets worse.

The War on Oud has left us with an invasion of iPod knockoffs that don’t last. That’s why you don’t find any collector’s market for them, either. Just like Apple’s resell value is rock solid, while the bootleg MP3 players don’t even last long enough to let you trade them in.

See, the oud world has ‘bull’ and ‘bear’ phases that it goes through, just like a regular stock market. But if you think about what oud really is, you quickly realize this is an ultra-exclusive, super limited item available to just a few people who have access to this information.

Ensar Oud oils are the “gold standard” of the oud market. Other ouds are a whole lot more volatile, due to the uncanny ways the oils are processed, and their lack of consistency. Ensar Oud distills oud in the most holistic, artisanally accepted methods that have been practiced for millennia. All we did is to bring a greater degree of scrupulousness in our selection of raw materials, along with perfecting the distillation setups. This, while other producers capitalize on ‘altering’ the traditional profile of agarwood oil, either by chemically modifying the raw material prior to and during distillation, or by distilling unconventional (e.g. inferior) raw material to begin with. This is done to capitalize on altering oud oil to present newer and newer aromatic profiles, even as the raw materials are exploited into extinction and replaced with increasingly inferior feedstock.

And there’s far more deception than meets the eye. Gold-coated bars are sold at the same prices as true gold. You see it all the time. An oud is advertised with corresponding pictures of the dark chips it was supposedly distilled from. But when we touch base at the distillery, the truth comes out. We happen to personally know many of the suppliers to well-known Middle Eastern and Western vendors, whom we visit during our travels. You ask the distiller about the wood he cooked for so-and-so, showing him the pictures and…… he’s as confused as you are. He did show them that wood (via social media, hardly ever in person). But that’s not what went into the pots. It never is.

Don’t Judge An Oud By Its Cover

This impacts you in many ways. For one, it means that you’re not smelling proper oud oil as you would have 10 years ago – a fragrance dictated by the quality of wood that went into each batch. Rather, what you now experience are the ‘experimentations’ of the distiller.

More importantly, your palate gets corrupted because you’re told the auxiliary-heavy makeup that covers up lesser grade materials is on par with genuine high-grade oud. This gets people confused, newcomers to oud especially.

That’s how you see Oud Ahmad (sinking-grade oud, aged sixteen years) compared to a $10/kg Malaysian distillations done last week. Folks with little to no experience with quality oud voicing their expert opinion on how Nha Trang LTD is “expensive” and how there are many cheaper oils – “just as good” – out there.

Fractionation & Aging

What this means for you is that, first and foremost, you’re getting an end product that might not age as well as traditional oud oil, so your investment may go ‘flat’ in a matter of a few years.

Always remember that ‘old’ oud does not automatically mean good oud, and that the vast majority of ouds coming out today have no track record at all. Just because Ensar Oud distillations age impeccably well doesn’t mean trader Joe’s will, too.

That’s because, secondly, the profiles are more and more experimental, meaning increasingly fractionated. Oud is the interaction of a thousand factors. Isolate them, and you get Oud Lite. What was once a “full on” resinous blast of agarwood notes is now a feeble, albeit sufficiently ‘unique’ ensemble of top notes without any core or base. You just don’t know yet how all the tinkering affects the oil. A bottle from Ensar Oud can be 30 years old and all the better for it, but get another oil, and for all you know your bottle might now have a shelf life, as you’d expect from any other fractionated essential oil.

The worst part is that many third-party vendors aren’t even aware this is happening to their ouds. All their source told them is: ‘Grade A chips went into copper with clean water, as per your innovative request. Please include the EMS charge in the bank transfer.’

Aside from that, the chemical synergy of ‘hoops’ and ‘loops’ that the raw material is subjected to before and during extraction, or the post-distillation tampering, leave you with ouds that just smell… nice. Nothing more. Generic oud that gets pumped out by the gallon ends up on the artisanal oud market. Decent oud at a reasonable price, you see. And unassuming folks give their thumbs-up because it’s so… nice.

To cover up the lackluster quality of their raw materials, distillers fractionate their oils to isolate single notes. They can’t ‘technique’ their way into giving you a solid high-end oud that only comes from premium agarwood, with its rich, layered complexity, so you end up with auxiliary ‘niceties’ sold as a novel innovation in oud distillation. But they’re never more than monotone, anemic top notes that remind you of run-of-the-mill essential oils like cinnamon (which only ever smells like cinnamon). And oud is always more…

You can pick up jasmine and amber and green apples in a single swipe of oud. But have you ever smelled agarwood in even the rarest jasmine, amber, or the reddest rose? Oud is always more.

The @ud Boom

Given that the speculative players who have jumped on this market would like to manipulate demand so that it results in higher sales for them, there is an ongoing campaign to ‘devalue’ traditional ouds, specifically Ensar Oud, in order to reflect a superior ‘value’ in their volatile offerings.

As an example, here’s another recent post on Basenotes by an anti-EO ambassador regarding the mushrooming newcomers to this market:

“It is almost 2018 there are so many new vendors that are selling excellent wild oud that is equal, some even have a lot better oud oils than Ensar Oud for a fraction of what Ensar is selling.

A lot more wild oud is available now than in 2012 and new vendors with excellent wild oils are available to the West.”

The person quoted above is not a distiller, nor a hunter, nor does he work for CITES. He has not seen an agarwood tree in his life, nor does he know how to organize grades of wood or at which angle the condenser goes for distilling it. But I see where he’s coming from. This is exactly what the disinformation that is flooding the internet aims to achieve: not only make you believe that I made up the rarity of wild agarwood, but that there is now a surplus of trees out there that anyone with access to Facebook can access.

I stand by everything I said in 2012. And I’ve got every failed hunt and retired hunter, every CITES official, every carver and cleaner, every dollar prices went up by, every distiller ON THE GROUND backing me.

Even a highly respected, unbiased fragrance reviewer like Kafkaesque, a notoriously independent critic of this market, has reached their own conclusions against such allegations. Kafkaesque’s candid (sometimes painfully so) views are hailed as a revered voice in the fragrance community, and if there’s anyone who would have a field day exposing a fraud, it would be Kafka. But, Kafkaesque’s independent research made them stand up for Ensar Oud when others were telling them not to. (Read Kafka’s conclusions here.)

Likewise, Chris McMahon, arguably the most widely respected person in the world of essential oils. Anyone who knows Chris knows he doesn’t beat around the bush. According to him, “the best source that I know of for authentic oud oil is Ensar Oud.”

So, what about the cheaper alternatives?

I’ve looked hard. There must be a secret club selling all these wild ouds that are ‘a lot better’ for ‘a fraction of the cost.’ Perhaps someone can let me know what I’m missing out on? Because I just haven’t seen another 11-year-old Maroke sell for a fraction of $550, nor a 9-year-old Burmese. Every Koh Kong oil I come across sells for more than Nhek 1976.

But you know what the worst part is? Why it’s called the War on Oud?

People calling for oud to be ‘democratized,’ to be ‘made cheap again,’ ‘affordable’ again, available to the bourgeoisie and the proletariat alike, plebs and princes, these are the very people who SUPPORT and ENCOURAGE everything we try to bypass in the oud world. By demanding what they do, they fund shady practices, premature harvesting, and indiscriminate distillation. One vendor sells ‘top-quality’ oud made from a tree with a pitch black resinous core, which was cut at only 9-10 years old – and they see no problem with it. Top-quality oud oil from a 9-year-old tree? Imagine that.

Fake Oud & Facebook

Most of the time I spend looking, sniffing and sorting agarwood for distillation goes into fighting how cultivated wood gets sold as wild. This must be the most widespread practice on the ground, far more so than the paint and the glue.

Of course, if you contact a distiller remotely, you’ll be sold a batch of ‘wild’ wood, or an oud that was distilled from ‘wild’ wood, and eventually, that oud makes its way onto the market as artisanal wild. That’s how people end up comparing mid-range cultivated oils to wild incense-grade Vietnamese distillations… and scoffing at us for saying there’s a difference.

Now, before my words come back to bite me, someone posted screenshots of a discussion I had with a distiller via Messenger (don’t ask me why or how he got it). This gets thrown back at me a lot, somehow proving that I am one of the ‘Facebook distillers’ I hold in such contempt. The person posted several screenshots showing the conversation, but I’ll just repost the last one, which I hope shows you how it is with Ensar Oud, and what we’re all about:

Facebook ‘friends’ contact me nonstop, I won’t deny that. But this proves that when I talk about being on the ground getting my hands dirty, I mean it. That’s simply what Artisanal Oud demands of you. In a business where the default is treachery and deceit, others would – and do – take the guy’s word for it and end up with an oil distilled from wood that’s NOTHING like what they’ll end up telling you it is. And that’s why these ouds are a weak currency.

Oud & Currency

The oud collectors’ market is distinct and solid, and like cryptocurrency, it’s revolutionary in that, rather than on Forex or Wall Street, it is traded between users directly, with no middlemen. Just look at all the people who invested in Oud Royale in 2005 at $390 a bottle, who can easily cash in on their investment at generous markups. Would you buy a bottle of Oud Royale for $2,500? What about $1,500? So would I. How about Borneo 3000. Yep. Same here. What about Oud Mostafa No 1, Oud Sulaiman No 1, or Oud Royale No 2? I would literally buy back any one of these oils if I could. That’s because when I sold these oils they represented excellent value.

Oud is unique as an asset class, in that it compares to exclusive artworks more so than ordinary commodities (like grains or soybeans). Because of that, it is highly unlikely that any of these oils is going down in value anytime soon. Their track record has proven them to be a robust store of value.

‘Crypto Oud’

I tried signing up to buy Bitcoin but my US passport is not sufficient proof of identity. My US passport. This, in a frenzied melt-up where everyone is crypto-crazy to get in. That should make you wonder: if you have this much trouble getting in, at a time they want you to get in, how will you fare getting out?

As people rush to invest any spare cash they have, the stock market is bound to crash. And most people won’t realize it until after the fact, stuck with stocks that are now worthless. It’s an inevitable cycle. When the economy is out of cash, there’s nobody left to buy stocks. Boom. Bust. But not everyone invests in stocks. Have you ever seen a Picasso that depreciated? How about a Rembrandt? Have you ever even seen a Rembrandt for sale anywhere?

Similarly with Sultan Sufyan. Once the oil sells, few are the collectors who will part with their collections and buyers constantly scan the market for available buy opportunities. Take a look at even our organic oils, like Oud Dhul Kifl and Oud Yaqoub, originally at $350 a bottle; they can now potentially sell for 30-50% gains. And this is an asset class you don’t need to register with Ameritrade or Fidelity in order to own. You don’t need to be stock savvy or know all about blockchains. And most importantly, it doesn’t take tens to hundreds of thousands of dollars to get in the game.

At a time of negative interest rates, the fact that your oud secures its value, never mind going up, is a fantastic achievement. From the US to India and China, you feel the tightening fiscal fist around your neck. The push to fully digitize your finances is so strong it’s already effective in countless sectors and countries, leaving solid, tangible commodities as your only handle on reality, and the safest place store your spare cash.

When people approach us about investing in oud, we make it clear that you should not expect overnight profit. Our advice has been to wait at least five years (longer only counts in your favor). Naturally, if everyone floods into the market at the same time (prematurely, on top of that), don’t expect next-day sellouts, and don’t use that as an indicator of market strength. Like stocks or fine art deals, timing matters. But the price of a Pollock doesn’t budge.

Still, many people who invested in oud in recent years have since sold their bottles (i.e. cashing in sooner than when we suggested). So much so, it’s with a spoonful of irony that these are the words of one prominent anti-Ensar mascot who is telling others not to buy oud: “Most of my collection has been sold, especially all that start with E.”

But not all ouds are equal. I would thus caution you when buying random offerings as highly volatile, risk-filled investments. For one, most of the vendors simply copy our blueprint when branding their products, without the firsthand supervision or quality control.

And if it isn’t clear by now, I’d urge you to have a closer look and see that Ensar Oud’s wild oils are gram for gram cheaper than the ‘cheaper’ alternatives, not to mention the years of aging others don’t – cannot – give you. So, you’re not even getting a cheaper daily wear in the end. If, when, the scent falls flat sometime down the line, all you can do is keep it as a memento.

Unlike Bitcoin where you could make it big next month, or also lose it all tomorrow, select ouds belong to a strong long-term asset class. But like Bitcoin, there are platforms and people you avoid dealing with.

For example, here’s a surefire way to secure the value of your assets: Persistently trash a certain vendor and then offer that vendor’s ouds at 1,000% markups. And if it doesn’t sell, complain that the gig is rigged. There are platforms doing precisely this, dedicated to undermining our name (coincidentally along with every other distiller we hold in any esteem) while at the same time they want their platform to be used to sell our oils. But let me ask you: Would you support a Bitcoin exchange that tirelessly works to sabotage Nakamoto?

The oudscape is changing rapidly. Faster than most realize. Soon, we won’t be able to distill the kind of ouds we can today. Just like it’s a Herculean feat to distill yesteryears’ oud today (as we predicted it would be in our End of Oud articles). To re-distill ouds that were available only a few years ago today, like Royal Kinam, takes scouring veteran collectors’ batches across the map to find the correct wood because it’s not available anywhere else, and we’re paying through our noses. Royal Kinam sold for $475 in 2007. It’s successor cost many times that much to make. If other distillers aren’t facing the same hurdles we are, they aren’t running on the same track.

Or perhaps we just haven’t yet discovered the secret to distilling these ‘superior’ ouds that ‘cost much less.’

Or does it make more sense that this new breed of oud is not made of the same caliber wood, nor with the same expertise? Does it make more sense that most of the ‘oud’ distilled in Indonesia and Malaysia is not pure agarwood (but to a novice nose smells like it) and can sell – as ‘oud’ – for much less? Does cutting your ‘Cambodi’ with ‘chantana’ make it cheaper?

Or is the most realistic scenario not simply one where you’re getting low to mid-range oud, marketed as high-grade ‘artisanal’?

Oud of the Year?

If any of the reports coming out of Sri Lanka prove even remotely accurate, Oud Royale (Sri Lanka, 2017) will be a bottle of oud that nobody, for love or money, will be able to make again. Not with veteran collector’s chips, or a Man truck stuffed with Bitcoin.

Chinese brokers all over the oud world have been fueling a boiling meltup, frantically – and indiscriminately – getting their hands on every last chip they can. And in Sri Lanka, the Chinese are already packing up shop. They carved and stockpiled what they came for and are heading home. The exchange is closed. Stocks are gone. The server is shutting down.

There’s a reason Oud Royale will go down as a Legend, and its price up. Just like there’s a reason you haven’t seen us launch any fresh Chinese ouds. Why I don’t list any Laotians. And there’s a very good reason select Vietnamese oud goes for thousands. Imagine we sold Kynam No 1 when it was first distilled. I’d be smashing my head against the wall – and you’d have gotten the bargain of a lifetime, just like others did with Kyara LTD and Royal Kinam. Oud Royale 2017 is no different, trust me. I invite anyone to give you a bottle of oud that gives you so much, for so little; to show you any ‘decent’ and ‘cheaper’ equal anywhere.

Skeptics are free to raise their eyebrows now, but we released Oud Royale for no other reason than to hand you a no-nonsense, ticks-all-the-boxes bottle of oud. To help drop the price as low as possible and make it even more accessible, we’re also offering it in a 2.5 gr option. (Order today to take advantage of the launch discount.)

In the Scramble for Cryptocurrency, the people who win are the ones who invested way back. For newcomers, it’s entirely up in the air. During the last few days alone, Bitcoin went from 14K to 16K to 20K, back to 14K, and last I checked it was down to 10K. Next week, it could be 15K, or it could be 3K.

You can imagine that when cryptocurrencies become a mainstream medium of exchange, the market will taper down considerably, and you won’t be making massive gains or suffering catastrophic losses any more than you would with conventional currency. Oud oil is a completely different game.

Mature, resin dense (high quality) wild agarwood is in rapid decline, and has been exponentially so since the birth of the China Market. As a result, the oud game can only play out in two ways:

- High-grade artisanal oud will become more and more expensive, or will cease to be produced entirely.

- Quality oud will take on a new meaning. Grade C of today will be the Grade A of tomorrow.

Both scenarios are already being played out before your very eyes. Artisanal oud costs more than ever to make. Oud Ahmad was distilled from sinking-grade agarwood, sixteen years ago. A bottle now retails for $2,500. Compare that to one of the only other sinking-grade distillations done recently that sells for $15,000 a bottle. And note: the distiller did not pay for the wood, nor has the oil naturally aged for 16 years. Yet, that’s a totally fair price in today’s market for what it is.

On the other hand, The War on Oud lobbyists tell you it doesn’t matter. The oud biz is booming and decent ouds at decent prices are available freely, and any quality difference is minor. Who cares if you distilled leu instead of seah? As long as it smells… nice. A Rolls Royce doesn’t get you to point B any faster than a Tata now, does it?

Expect that the trend will continue in line with point 2. You’ll see a new breed of oud that will continue to be sold as ‘artisanal’, ‘incense-grade’, ‘custom-distilled’, etc. But it won’t be what we ever meant by those terms. No matter how much the anti-OUD lobbyists want to you to believe otherwise, true high-grade oud oil is a dying breed.

Now, Oud Royale might be the olfactory equivalent of early crypto or Facebook stocks, but there’s a key difference…

Facebook goes down to virtual reality. The crypto-craze gets old… or implemented on a mass scale, dragging down its asset value with force. Meanwhile, the Mona Lisa still hangs in the Louvre. Briefcase full of cash, you still can’t find that Rembrandt. How many people do you know who wouldn’t kill to drive a Shelby Cobra?

Stocks appear and disappear, and a printing machine has the power to determine your pension. (Who will ‘print’ Bitcoin, and how much of it, by the way?) But art is timeless. And art that’s disappearing is the most valuable kind there is.

You might not want to keep a 60s Mustang parked in the garage. You prefer to feel the wind in your hair as you stamp its clutch down. So, I suspect that once you smell it, keeping your bottle of Oud Royale will be the last thing on your mind. But if you do decide to hang onto it, you know you own a high-value physical asset that’s more secure than any cash you’ve got lying around. And because we’re practically going back in time with our pricing, you have good reason to expect a handsome return in a few years when the like of it lies buried beneath the dried mud and new roads built in Sri Lanka after the floods. But if you missed out on getting a bottle while you could have, at this price, you’d be taking a whiff of all the ‘cheap’ and ‘decent’ concoctions that would by then have flooded the market. And you’d wish you could get a swipe of OUD again.